Wednesday, 29 January 2014

Sunday, 5 January 2014

LIC New Jeevan Anand Policy Table No 815

LIC New Jeevan Anand Policy Table No 815

What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~

125% of Basic Sum Assured (1.25 x BSA)

OR

10 times Annual Premium. (10 x AP).

The death benefit as defined above shall not be less than 105% of total premiums* paid as on the date of death.

[*excluding taxes, extra premiums and premiums for riders, if any]

Particulars | Jeevan Anand Plan No. 149 | New Jeevan Anand Plan No. 815 | ||

Age at entry | 18 to 65 years | 18 to 50 years | ||

Age at Maturity | Maximum 75 years | Maximum 75 Years | ||

Policy Term | 5 to 57 years | 15 to 35 years | ||

Premium mode | Yearly, Half-yearly, Quarterly, Monthly (SSS or ECS) | Yearly, Half-yearly, Quarterly, Monthly (SSS or ECS) | ||

Basic Sum Assured | 100000 and above | 100000 and above ( In multiples of 5000) | ||

Mode | Rebate | |||

Plan 149 | Plan No. 815 | |||

Yearly | 3% of tabular Premium | 2% of tabular premium | ||

Half-yearly | 1.5% of tabular premium | 1% of tabular premium | ||

Quarterly | Nil | Nil | ||

Plan No 149 Jeevan Anand | Plan No. 815 New Jeevan Anand | ||

Basic Sum Assured | Rebate (Rs.) | Basic Sum Assured | Rebate (Rs.) |

10,00,000 and above | 1.75‰ BSA | 10,00,000 and above | 3.00‰ BSA |

5,00,000 to 9,95,000 | 1.50‰ BSA | 5,00,000 to 9,95,000 | 2.50‰ BSA |

3,00,000 to 4,95,000 | 1.00‰ BSA | 2,00,000 to 4,95,000 | 1.50‰ |

1,00,000 to 2,95,000 | Nil | 1,00,000 to 1,95,000 | Nil |

Jeevan Anand Plan No. 149 | New Jeevan Anand Plan No.815 |

Available after payment of 3 full year’s premiums. | Available after payment of 3 full year’s premiums. |

Loan granted shall be 90% of the Surrender Value in case of in force policies and 85% of the Surrender Value in case of Paid-up policies irrespective of the policy term. | The maximum amount of loan that can be granted as a percentage of Surrender Value shall depend on the Policy Term, as given in the table below. |

Foreclosure action was initiated on default of 2 or more half-yearly loan interest installments. | Foreclosure action shall not be taken under fully paid-up and in force policies even if there is a default of loan interest. |

Policy Term | Upto 23 | 24 to 27 | 28 to 31 | 32 to 35 |

% for in force policies | 90% | 80% | 70% | 60% |

% for Paid-up policies | 80% | 70% | 60% | 50% |

Plan No.149 | Plan No. 815 |

Guaranteed Surrender Value (GSV) | Guaranteed Surrender Value (GSV) |

Available after payment of 3 full years’ premiums. | Available after payment of 3 full years’ premiums. |

GSV shall be equal to 30% of the total premiums paid less First Year Premium and extra premium, if any. | GSV shall be a percentage of total premiums paid (net of taxes) excluding extra premium, if any and premium paid for riders, if opted for. Examples of GSV factors applicable for total premiums paid Policy Year ~ GSV factor 3 = 30% 5 = 50% t -1 = 80% (t=Policy Term) |

Cash Value of vested bonuses, if any. | GSV factor applicable to vested bonus, if any. Examples of Vested bonus factors – Year of SV – Policy Term – Factor 3 15 17.66% 19 25 20.85% 29 30 30% |

Jeevan Anand Plan No. 149 | New Jeevan Ananad Plan 815 |

Special Surrender Value (SSV) | Special Surrender Value (SSV) |

Surrender Value shall be the discounted value of the Paid-up Sum Assured and vested simple reversionary bonuses. | Surrender Value shall be the discounted value of the Paid-up Sum Assured and vested simple reversionary bonuses. |

The discount factors shall be surrender value factors as provided in Table-1A and 2A (whole life) of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy. | The discount factors shall be Special surrender value factors as provided in Table-1A and 2A (Whole life) of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy. |

Surrender Value Payable | Surrender Value payable |

The Higher of Guaranteed Surrender Value and Special Surrender Value shall be payable. | The Higher of Guaranteed Surrender Value and Special Surrender Value shall be payable. |

Jeevan Anand Plan No. 149 | New Jeevan Anand Plan No. 815 |

A Policy may be revived within a period of 5 years from the date of first unpaid premium. | A Policy may be revived within a period of 2 years from the date of first unpaid premium. |

Accident Benefit inbuilt. | Accident Benefit as a rider. |

Taxes, if any, were borne by the corporation. | Taxes, if any, shall be applicable at the prevailing rates and borne by the policyholder as per rules. |

There shall be no change in the following Items |

Back Dating |

Grace Period |

Paid-up Value |

Assignment/Nomination |

Lic New Jeevan Anand Plan Table No 815 from Satyendra Gupta

jeevan anand chart

LIC New Jeevan Anand Plan Table No 815 Illustration

Related Plans : LIC New Endowment Plan Table No - 814

LIC Money Back Plan for 25 Years Table No 821

Money Back Plan for 25 Years (Table No 821)

A Policy may be revived within a period of 2 years from the date of first unpaid premium.

Taxes, if any, shall be applicable at the prevailing rates and borne by the policyholder as per rules.

Maturity Benefit - 40% of the Basic Sum Assured along with Vested Simple Reversionary Bonuses and Final Additional Bonus, if Any

Death Benefit -Sum Assured on Death’ along with Vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

The death benefit as defined above shall not be less than 105% of total premiums* paid as on the date of death.

What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~ 125% of Basic Sum Assured (1.25 x BSA)

OR 10 times Annualized Premium. (10 x AP).

[*Premiums - excluding taxes, extra premiums and premiums for riders, if any]

SURVIVAL BENEFIT (as a percentage of Sum Assured)

Policy Year | 5th | 10th | 15th | 20th |

Survival Benefit Payable | 15% | 15% | 15% | 15% |

Paid –up value shall be equal to (Number of premiums paid/ Total Number of premiums payable) x Basic Sum Assured less total amount of Survival Benefits paid under the policy.

Eligibility Conditions and Restrictions

· Age at entry - 13 to 45 years

· Age at Maturity - Maximum 70 Years

· Policy Term - 25 years

· Premium Paying Term – 20 Years

· Premium mode – Yearly, Half-yearly, Quarterly, Monthly (SSS or ECS)

· Basic Sum Assured - 1,00,000 and above ( In multiples of 5000)

Loan – Available after payment of 3 full years’ premiums.

The maximum amount of loan that can be granted as a percentage of Surrender Value be as under:

· For enforce and fully paid-up policies – up to 90%

· For paid-up policies – 80%

· Foreclosure action shall not be taken under fully paid-up and enforce policies even if there is default of loan interest.

Surrender Value-

Guaranteed Surrender Value (GSV) - Available after payment of 3 full years premiums.

GSV shall be a percentage of total premiums paid (net of taxes) excluding extra premium, if any and premium paid for riders, if opted for. Less any Survival Benefits already paid.

Examples of GSV factors applicable for total premiums paid

Policy Year ~ GSV factor

3 = 30%

5 = 50%

t -1 = 80% (t=Policy Term)

GSV factor applicable to vested bonus, if any. Examples of Vested bonus factors –

Year of SV – Factor

3 15.28%

20 21.99%

24 30%

Special Surrender Value (SSV) - Surrender Value shall be the discounted value of the Paid-up Sum Assured and vested simple reversionary bonuses.

The discount factors shall be special surrender value factors as provided in Table-1A of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy.

The Higher of Guaranteed Surrender Value and Special Surrender Value shall be payable.

Lic New Money Back Table No 821-25 years from Satyendra Gupta

LIC Money Back Plan for 25 Years Table No 821 Premium Chart

LIC Money Back Plan for 25 Years Table No 821 Illustration

LIC Money Back Plan for 20 Years Table No 820

Money Back Plan for 20 Years (Table No 820)

Service Tax shall be applicable at the prevailing rates and borne by the policyholder as per rules.

Maturity Benefit - 40% of the Basic Sum Assured along with Vested Simple Reversionary Bonuses and Final Additional Bonus, if any

Death Benefit -‘Sum Assured on Death’ along with Vested Simple Reversionary Bonuses and Final Additional Bonus, if any.

The death benefit as defined above shall not be less than 105% of total premiums* paid as on the date of death.

What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~ 125% of Basic Sum Assured (1.25 x BSA)

OR 10 times Annualized Premium. (10 x AP).

[Premiums - excluding taxes, extra premiums and premiums for riders, if any]

SURVIVAL BENEFIT (as a percentage of Sum Assured)

Policy Year | 5th | 10th | 15th |

Survival Benefit Payable | 20% | 20% | 20% |

Paid –up value shall be equal to (Number of premiums paid/ Total Number of premiums payable) x Basic Sum Assured less total amount of Survival Benefits paid under the policy.

Eligibility Conditions and Restrictions

· Age at entry - 13 to 50 years

· Age at Maturity - Maximum 70 Years

· Policy Term - 20 years

· Premium Paying Term – 15 Years

· Premium mode – Yearly, Half-yearly, Quarterly, Monthly (SSS or ECS)

· Basic Sum Assured - 1,00,000 and above ( In multiples of 5000)

Loan – Available after payment of 3 full years’ premiums

The maximum amount of loan that can be granted as a percentage of Surrender Value be as under:

· For enforce and fully paid-up policies – up to 90%

· For paid-up policies – 80%

· Foreclosure action shall not be taken under fully paid-up and enforce policies even if there is default of loan interest

Surrender Value-

Guaranteed Surrender Value (GSV) -

· Available after payment of 3 full years’ premiums.

· GSV shall be a percentage of total premiums paid (net of taxes) excluding extra premium, if any and premium paid for riders, if opted for. Less any survival Benefits already paid.

· Examples of GSV factors applicable for total premiums paid

Policy Year ~ GSV factor

3 = 30%

5 = 50%

t -1 = 80% (t=Policy Term)

GSV factor applicable to vested bonus, if any. Examples of Vested bonus factors –

Year of SV – Factor

3 16.21%

10 18.16%

19 30%

Special Surrender Value (SSV) - Surrender Value shall be the discounted value of the Paid-up Sum Assured and vested simple reversionary bonuses.

The discount factors shall be special surrender value factors as provided in Table-1A of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy.

The Higher of Guaranteed Surrender Value and Special Surrender Value shall be payable.

LIC New Money Back plan table no 820 - 20 years from Satyendra Gupta

LIC Money Back Plan for 20 Years Table No 820 Premium Chart

LIC Money Back Plan for 20 Years Table No 820 Illustration

LIC New Endowment Plan Table No 814

LIC’s NEW ENDOWMENT PLAN

LIC's New Endowment Plan is a participating non-linked plan which offers an attractive combination of protection and saving features. This combination provides financial support for the family of the deceased policyholder any time before maturity and good lump sum amount at the time of maturity for the surviving policyholders. This plan also takes care of liquidity needs through its loan facility.

LIC’s NEW ENDOWMENT PLAN Benefits:

Death benefit:

In case of death during the policy term provided all due premiums have been paid Death benefit, defined as sum of "Sum Assured on Death" and vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable. Where, “Sum Assured on Death” is defined as higher of Basic Sum Assured or 10 times of annualised premium. This death benefit shall not be less than 105% of all the premiums paid as on date of death.

Where premiums exclude service tax, extra premium and rider premiums, if any.

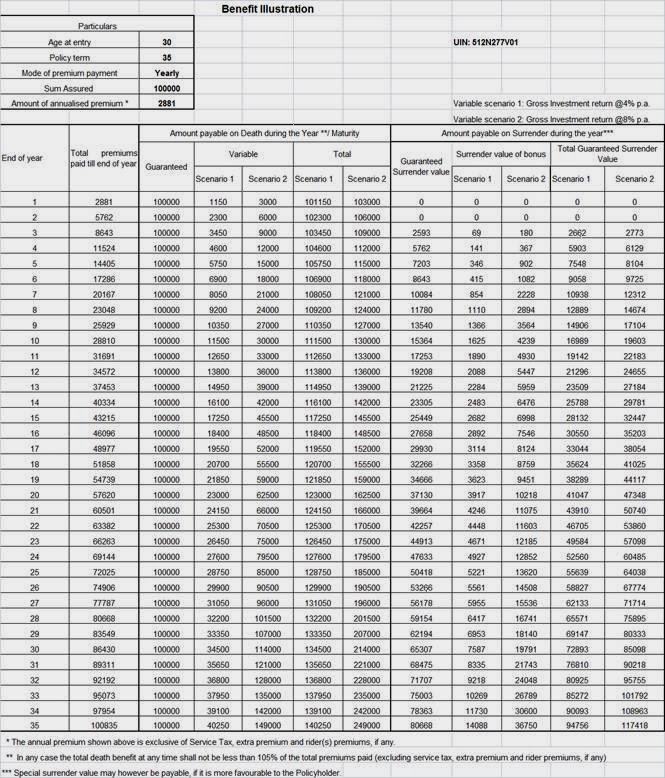

Lic New Endowment Plan Illustration Calculator

Maturity Benefit:

Basic Sum Assured, along with vested simple reversionary bonuses and Final Additional bonus, if any, shall be payable in lump sum on Survival to the end of the policy term provided all due premiums have been paid.

Participation in Profits: The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation, provided the policy is in full force.

Final (Additional) Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity, provided the policy has run for certain minimum term.

Optional Benefit:

LIC’s Accidental Death and Disability Benefit Rider: LIC's Accidental Death and Disability Benefit Rider is available as an optional rider by payment of additional premium. In case of accidental death, the Accident Benefit Sum Assured will be payable as lump sum along with the death benefit under the basic plan. In case of accidental permanent disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured which is equal to Accident Benefit Sum Assured under the policy, shall be waived.

The death benefit as defined above shall not be less than 105% of total premiums* paid as on the date of death.

What is Sum Assured on Death?Sum Assured on Death shall be higher of ~ Basic Sum Assured (BSA)

OR 10 times Annualized Premium. (10 x AP).

[*The premiums mentioned in death benefit are excluding taxes, extra premiums and premiums for riders, if any]

Lic New Endowment Plan Eligibility Conditions and Restrictions

· Age at entry – 8 to 55 years

· Age at Maturity – Maximum 75 Years

· Policy Term – 12 to 35 years

· Premium mode – Yearly, Half-yearly, Quarterly, Monthly (SSS or ECS)

· Minimum Basic Sum Assured – 100000 and above

(The Basic Sum Assured shall be in multiples of Rs. 5000/-)

· Maximum Sum Assured – No Limit

1. Minimum Accident Benefit Sum Assured : Rs. 100,000

2. Maximum Accident Benefit Sum Assured :

An amount equal to the Sum Assured under the Basic Plan subject to the maximum of Rs.50 lakh Accident Benefit Sum Assured taking all existing policies of the Life Assured under individual as well as group schemes including policies with in-built accident benefit taken with Life Insurance Corporation of India and the Accident Benefit Sum Assured under the new proposal into consideration.

(The Accident Benefit Sum Assured shall be in multiples of Rs. 5000/-)

1.Minimum Age at entry : 18 years (completed)

2.Maximum Age at entry : The cover can be opted for at any policy anniversary during the policy term but before the policy anniversary on which the age nearer birthday of the Life Assured is 70 years.

3.Maximum cover ceasing age : 70 years (nearest birthday)

(The Basic Sum Assured shall be in multiples of Rs. 5000/-)

· Maximum Sum Assured – No Limit

For LIC’s Endowment Plan Accidental Death and Disability Benefit Rider

1. Minimum Accident Benefit Sum Assured : Rs. 100,000

2. Maximum Accident Benefit Sum Assured :

An amount equal to the Sum Assured under the Basic Plan subject to the maximum of Rs.50 lakh Accident Benefit Sum Assured taking all existing policies of the Life Assured under individual as well as group schemes including policies with in-built accident benefit taken with Life Insurance Corporation of India and the Accident Benefit Sum Assured under the new proposal into consideration.

(The Accident Benefit Sum Assured shall be in multiples of Rs. 5000/-)

1.Minimum Age at entry : 18 years (completed)

2.Maximum Age at entry : The cover can be opted for at any policy anniversary during the policy term but before the policy anniversary on which the age nearer birthday of the Life Assured is 70 years.

3.Maximum cover ceasing age : 70 years (nearest birthday)

Loan Benefit Under LIC New Endowment Plan

Available after payment of 3 full years’ premiums.The maximum amount of loan that can be granted as a percentage of Surrender Value shall depend on the Policy Term.

Foreclosure action shall not be taken under fully paid-up and enforce policies even if there is default of loan interest.

Guaranteed Surrender Value (GSV) - Available after payment of 3 full years premiums.

GSV shall be a percentage of total premiums paid (net of taxes) excluding extra premium, if any and premium paid for riders, if opted for.

Examples of GSV factors applicable for total premiums paid

Policy Year ~ GSV factor

3 = 30%

5 = 50%

t -1 = 80% (t=Policy Term)

GSV factor applicable to vested bonus, if any. Examples of Vested bonus factors –

Surrender Value shall be the discounted value of the Paid-up Sum Assured and vested simple reversionary bonuses.

Year of SV – Policy Term – Factor

3 12 18.60%

19 25 20.85%

29 30 30%

(In multiples of 5000)

Special Surrender Value (SSV)

The discount factors shall be surrender value factors as provided in Table-1A of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy.

The discount factors shall be surrender value factors as provided in Table-1A of the Special Surrender Value Booklet and will depend upon the policy term and duration elapsed since the commencement of the policy.

Surrender Value payable – The Higher of Guaranteed Surrender Value and Special Surrender Value shall be payable.

LIC’s New Endowment Plan – Changes over Table No.14

1. Sum Assured on Death’ has been defined separately

2. Age at entry has been reduced.

3. Percentage of Loan payable as a percentage of Surrender Value shall depend upon policy term.

4. GSV percentage shall also depend on policy term and year of Surrender

5. Rebates for high SA and premium mode modified.

LIC New Single premium Endowment Plan 817-2014 from Satyendra Gupta

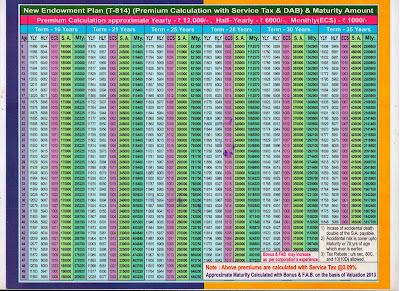

LIC New Endowment Plan Table No 814 Premium Chart

LIC New Endowment Plan Table No 814 Illustration

LIC 814, LIC table no 814,premium chart, LIC plan no 814 premium chart

Related Plans : LIC New Jeevan Anand Plan Table No - 815

Subscribe to:

Comments (Atom)