LIC Bima Diamond Plan Details

LIC Bima Diamond plan is the new Money Back insurance policy from LIC of India. It is a non-linked, traditional money back insurance policy. This plan provides financial support for the family not only during the policy term but also beyond the policy term during Extended Cover period.

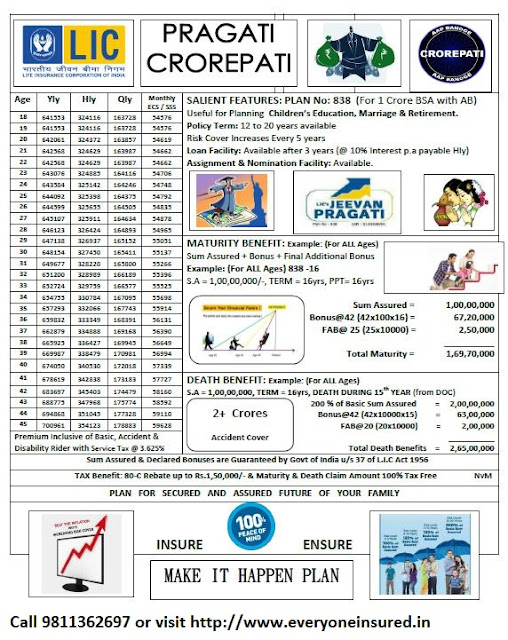

Bima Diamond is the new money back plan of LIC in 2016. In the beginning of the year, the LIC has launched the LIC Jeevan Labh, LIC Jeevan Shikhar (Closed now) and LIC Jeevan Pragati.

LIC Bima Diamond Plan Features

LIC Bima Diamond Plan Benefit & Features

Minimum Sum Assured

The minimum sum assured for the LIC Bima Diamond Plans should be Rs 1 lac.Maximum Sum Assured

LIC Bima diamond plan offers maximum Rs 5 lacs of Sum Assured. You cannot take sum assured of 5 lacs under this plan. For more sum assured you can take LIC Endowment Plan 814.Policy Term / Premium Paying Term

16/10, 20/12 & 24/15 years where 16,20 & 24 is Policy Term while 10, 12 & 15 are premium paying term.

Minimum age at Entry

LIC Bima diamond is a Money back plan so you can take it for your son or daughter who are older then 18 years or for yourself. The minimum age for this policy is 14 years (nbd).

Maximum age at Entry

16 Years Policy Term : 50 years (nbd)

20 Years Policy Term : 45 years (nbd)

24 Years Policy Term : 41 years (nbd)

Maximum age at Maturity

16 Years Policy Term : 66 years (nbd)

20 & 24 Years Policy Term : 65 years (nbd)

Extended Cover Period

Bima Dimaond covers extended cover period, i.e for 16/10 years term policy extended cover would be next 8 years i.e. you will be covered for 24 years while for 20/12 policy you will be covered for 20 years & for 24/15 plan you will be covered for 36 years. This period starts after elapsation of policy term and applicable for inforce policies as on the date of maturity.

Date of Commencement of Risk

Under Bima Diamond plan, risk will be immediately commenced from the date of issue policy.

Date of issuance of policy is a date when a proposal after underwriting is accepted as a policy and the contract gets effected between LIC and Customer.

Auto Cover

Auto Life cover is provided for 2 years even if the premium is not paid. This benefit will be extended only if 5 policy years are completed.

LOAN

Loan facility is available in this plan only after payment of premiums are paid at least 3 full years with few below conditions:

For Inforce policies : Upto 90%

For paid up policies : Upto 80%

Percentage may vary time to time. For more details contact us.

Death Benefits in LIC’s Bima Diamond

In case of the death of Life Assured before the date of MaturityDuring the first 5 policy years “Sum Assured on Death” will be paid to the nominee in Bima Diamond.

After completion of 5 policy years but before the date of maturity: “Sum Assured on Death” and Loyalty addition (if any) will be paid to the nominee of the Life Assured.

The death benefit will not be less than the 105% of all the premium paid in the policy as at the date of death of the life assured. (The premium referred above will not include any taxes, extra amount charged due to underwriting decision and rider premium, if any.)

In case of the death of Life Assured during the extended cover period

An amount equal to 50% of Basic sum assured will be paid to the nominee.

LIC’s Accidental Death and Disability Benefit Rider

If this benefit is opted for, an additional amount equal to “Accidental Benefit sum Assured” is Payable on death due to Accident, provided the rider is inforce at the time of the accident. In the case of the accidental permanent disability (within 180 days from the date of accident) an additional amount equal to “Accidental Benefit sum Assured” is Payable in equal monthly installments spread over 10 years. The future premium will be waived for the accidental benefit rider and premiums for the portion of Basic sum assured will be waived. This rider can be taken at the inception of the policy or before the premium term is over.LIC’s New Term Assurance Rider

If this benefit is opted for, an additional amount equal to “Term Assurance Rider sum Assured” is Payable on death to nominee, provided the rider is inforce at the time of the death of the Life Assured. This rider can be taken at the inception of the policy.

Survival Benefits in LIC’s Bima Diamond

If life assured survives to the specified duration during the policy term, then a fixed percentage of Basic Sum Assured is will be payable to the life assured. The fixed percentage in various terms are mentioned below:Bima Diamond Money Back

Guaranteed Money back every 4 Years, during the policy term. Bima Dimaond Money back after every 4 yrs 15% in 16 and 20 yrs term plan and 12% of BSA (Basic Sum Assured) in 24 yrs term.Example:

For Policy Term 16 years :

15% of BSA at the end of each of 4, 8, 12 policy year. It means if you have taken a Sum Assured of 5 Lacs, you will get 75 thousand 4th, 8th & 12th policy year.

For Policy Term 20 years :

15% of BSA at the end of each of 4, 8, 12, 16 policy year. It means if you have taken a Sum Assured of 5 Lacs, you will get 75 thousand 4th, 8th , 12th & 16th policy year.

For Policy Term 24 years :

12% of BSA at the end of each of 4, 8, 12, 16, 20 policy year. It means if you have taken a Sum Assured of 5 Lacs, you will get 60 thousand 4th, 8th , 12th, 16th & 20th policy year.

LIC lic-bima-diamond-money-back-plan-841-presentation

LIC Bima Diamond Money Back Plan 841 Presentation

If the Life Assured survives till the end of the policy term, “Sum Assured on Maturity” along with Loyalty Addition, if any will be payable to the Life Assured.

Where “Sum Assured on Maturity” in LIC Bima Diamond 841 is

55% of Basic Sum Assured in policy term 16 years

40% of Basic Sum Assured in Policy terms 20 and 24 years.

Optional Benefits in LIC’s Bima Diamond

Proposer can opt for the optional riders by payment of additional premium. Benefits under the optional rider will be available during the policy term only.